Welcome to this edition of “Assume and Doom” where we continue to explore inflationary purchase behavior. What we found might surprise you:

- Consumers believe once prices go up they never come down

- Historically, consumers turn to discount stores to save money – but Asian markets? It’s a new trend we weren’t expecting

- Even in trying economic times, consumers frown upon companies altering or cheapening their products to keep prices down

Check out Chapter 1 (https://www.quester.com/assume-and-doom-chapter-1-sustainability-and-organic-food-behavior-during-inflation/), to see a related topic we explored—consumer purchase behavior of sustainable and organic foods in this inflationary period and how the narrative is a little different than we might expect.

Assumption: Consumers are changing their spending behavior and taking a wait-and-see approach due to inflation and a possible future recession.

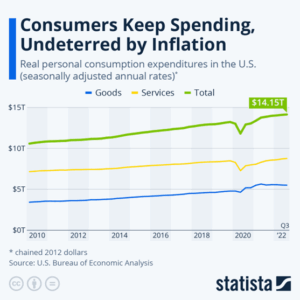

VERDICT: Maybe on some things, but it seems more of a changing mindset: It’s pretty predictable that spending behavior changes during economic uncertainty, but as we’ve seen in the news over the past six months, consumer spending and job additions have continued to grow despite inflationary pressures.

After the initial drop at the beginning of the pandemic in 2020, spending has continued to rise. The February 2023 U.S. jobs numbers showed 311,000 new jobs added, which is healthy but slower than January 2023 where 504,000 jobs were added. Plus, wages only rose 0.2% in February, the slowest gain in a year. Despite inflation and higher interest rates, the job market is forecast to still be strong due to Baby Boomers exiting the workforce and the rise in freelance/part-time work/flexible jobs.

What has been buried among all the inflation/supply chain issues is that costs for many mainstream items have not risen that much, or in the case of many electronics, have dropped. According to the World Economic Forum in November 2022:

- Public transportation costs have only risen 1.9% YOY despite fuel costs rising 48%

- Rising costs have been tougher for meat eaters than those on plant-based diets. Fish, beef, poultry, and eggs costs have risen 14% while products like tomatoes (+1.7%), potatoes (+2.7%), and bananas (+6.3%) have risen at a much slower rate.

- Electronics, which many think would be affected due to the lack of processors and other supply chain issues, saw prices drop in many categories, like TVs (-1.5%), audio equipment (-3%), video equipment (-3.6%), and especially smartphones (-13.5%).

But we know most of this. The more interesting, developing theme is the normalization of cost increases; consumers assume they won’t go down. Consumers hope prices won’t continue to rise, but there appears to be a resignation that once prices are elevated, they never go down to where they were.

My gut is telling me even (if airlines decided to fly) with one pilot, ticket prices won’t go down.

Worst part is that it’s not even worth waiting because the prices won’t go down.

Doesn’t matter if inflation eases or not. Inflation has happened, living costs are what they are.

My prediction is that prices won’t go down significantly because we (the U.S.) didn’t go up as much as other markets.

Well, I heard yesterday that the ‘experts’ tell us inflation will be easing on Americans. By next year. No, prices won’t go down. They just won’t rise as fast.

Assumption: Consumers are cutting back a bit on large purchases.

VERDICT: This is more nuanced than simply dollars. Consumers are scrutinizing everyday purchases in an effort to cut back. A natural outcome of examining products closely is discovering some ingredient lists have changed, and some products are made more cheaply and/or with inferior ingredients, much to consumers’ dismay.

It’s logical to think cutting back equates to high-dollar purchases as the quick and easy way to watch finances regardless of the economic climate. What isn’t always watched as carefully are the everyday purchases that really add up. The “convenience” or “optional” items seem to really be under the consumer microscope now.

For myself, I used to buy ready made salads, especially the sesame chicken salad. However, at $5.49, the price has gotten to the point I’d rather just buy the pre-washed greens in a bag which have remained rather flat compared to the ready made salads. $5.49 for a mediocre salad that does not bring me joy at the price point is a no go.

I definitely tend to eat more of the heat and serve meals when it’s too hot to cook, but I’m realizing this year I really can’t do it.

Makeup. I buy what I need now, not adding “fun” products I’ve seen online but I’ll realistically never use.

Less meat, more frozen staples like veggies (to lessen my food waste), not buying desserts, limiting fun snack items. I’m also not buying anything on a whim- anything new I don’t buy unless it’s been raved about here and I’ve written it on my list. Even then I’m hesitant depending on pricing tbh. I’ve been going to Sprouts or Asian markets for produce.

That last comment about going to Asian markets for produce also seems to be an inflationary trend. It’s been very common over the years for consumers to switch to retailers like Walmart and Aldi during times of personal or national economic uncertainty as well as more bulk shopping at warehouse clubs. However, switching to Asian markets because of lower prices for produce is a fairly new narrative.

Asian supermarkets are the go to place for fresh fruits and vegetables etc.

Chinese supermarkets are great for produce and good prices. You can also buy bulk items (like grains and rice) at the Indian grocery stores.

Yuan Ming (local Asian market) is newly renovated and has the best prices for produce and meat.

Scrutinizing extends beyond prices to ingredients as consumers decide where to spend their hard-earned and valuable cash. It’s a reasonable assumption that consumers would appreciate companies’ efforts to lower the cost of their products, then pass those savings onto shoppers. However, even in times of trying to save money, consumers don’t seem to want their favorite products altered or made cheaply. From the tone of the narratives, it seems as if consumers don’t think cheaper ingredients are to help them but rather for the companies’ financial benefit at the expense of a once good thing.

Breyers comes to my mind. For some reason wound up reading the Breyers ingredients list now: Milk, Cream, Sugar, Corn Syrup, Whey, Egg Yolks, Carob Bean Gum, Mono And Diglycerides, Salt, Natural Flavor, Vanilla Extract*, Annatto (for Color), Guar Gum, Tara Gum. So they sold me a brand image almost 40 years ago and I believed it and somewhere in between they quietly changed their formula to save money and became everything they promised they were not.

Another big one for me is It Cosmetics Bye Bye Concealer! Remember they relaunched it about two years ago with a MASSIVE array of shades? I’m convinced the formula is different! Not as thick, not as emollient, a little weirder on the blend…!

It’s definitely different. I’m a huge hot sauce fan, and I’ve never had COVID. The taste is definitely different. Even the color. I have packets from before and after – there is a difference! Wish I knew how to share a pic here. It’s obvious. [Taco Bell]

The chocolate itself has been crap since the Mondelez recipe changes too. Cadbury’s used to be my comfort fave. Creme eggs were the final straw.

Q: What happened to After Eight (chocolate mints)?

A: Cost of some ingredients has also shot up, so they now use cheaper ingredients or less of the expensive ones to keep costs down.

Yeah I feel like when Unilever bought Ben & Jerry’s the ingredients list blew up.

If companies assume they can pull one over on the consumer, these narratives show consumers aren’t fooled and easily notice differences in their common or favorite purchases, either by taste, feel, or simply reading the ingredients.

It’s obvious consumers will always look for ways to cut back in times of economic uncertainty. But the assumption that it’s only cutting back on large purchases or that they’ll accept inferior versions of their regular purchases can cause companies to make wrong decisions that don’t meet consumers’ needs. This scrutiny is part of people making the best decision for quality products and, clearly, aren’t just buying anything. With today’s consumer wielding the power, what is your brand doing to respect this power shift?

Quester’s series “Assume and Doom,” presents some prevalent assumptions, then brings clarity to them using our intuitive and informative ability to dig into social narratives to see what consumers are saying about these issues. So many times, people on all levels within a company hear about trends and buzzwords or read one article about a topic and make assumptions based on limited information. They then sometimes make knee-jerk decisions that do not help their business. We’re here to bring clarity to current issues so companies don’t fall prey to the “Assume and Doom.”

While most social listening/analytics quantifies large ideas and metrics, Quester social narratives go underneath the numbers to explain consumer behaviors, emotions, and motivations. We focus on the deep “why,” offering insight into implications, directions, and whitespaces. Because all consumer decisions are influenced by narratives—what they hear, read, watch, and discuss; social listening or analytics may not fully explain, analyze, or break down how these narratives affect consumer behavior.

While sometimes these assumptions will be an easy “true” or “false,” in most cases, as is common with human behavior, we’re predicting there will be a lot of nuances. Issues like these generally are not black-and-white.

The quotes you see in these articles are pulled from the various social platforms from which we analyzed the narratives and are representative of many thousands of discussions about the themes, not as “one-off” quotes from a qualitative study.